You may have heard about the Inflation Reduction Act (IRA) which was passed at the beginning of 2023 to reduce the effects of US carbon pollution in the face of the current climate crisis. The IRA includes significant investments that can benefit homeowners in North County who make energy-efficient upgrades to their home. These benefits come in the form of tax credits—up to $3200 per year—and rebates on new HVAC, electrical, and plumbing fixtures. You can also save money on your energy bill!

25C Energy Efficient Home Improvement Tax Credit

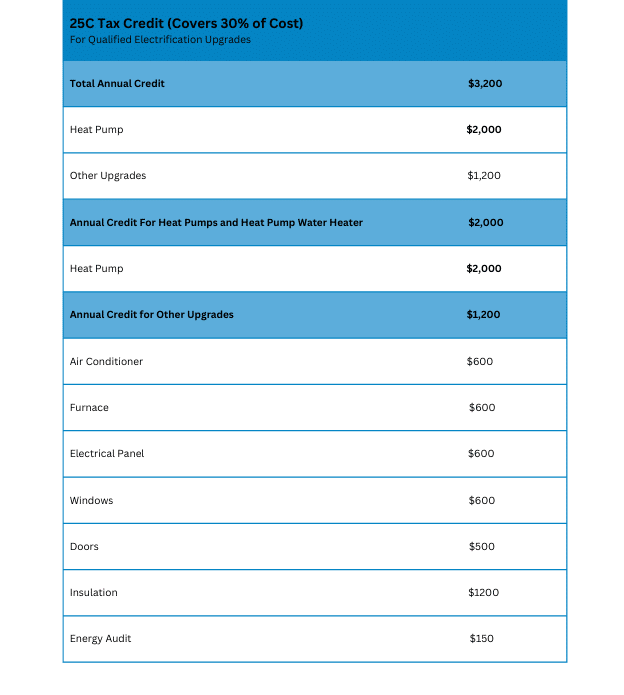

Homeowners who make energy-efficient upgrades like heat pumps, energy efficient doors and windows, and heat pump water heaters will be eligible for the tax credit included in the Inflation Reduction Act. This is an extension of the existing 25C tax credit, which allows homeowners to deduct up to 30% of the cost of certain home improvements, up to a maximum of $3,200 per year. If you’re looking to make some updates to your home and save some money in taxes and on your energy bill, the professionals at Sherlock Air can provide you with all the necessary information about available appliance options and installation procedures. Give us a call at 760-935-6101.

It’s important to note that there are certain specific requirements that must be met for new appliance installations or home upgrades. Get all the details about the Energy Efficient Home Improvement Tax Credit here.

For North County, CA homeowners who are thinking of making energy-saving changes this year, it’s worth exploring the potential tax benefits that come with the Inflation Reduction Act and the Energy Efficient Home Improvement Tax Credit. The experts at Sherlock Air can help determine what makes the most sense for your home and guide you through the process of qualifying for the tax credit. Call us at 760-935-6101.

Check out the chart below to see which energy efficient appliances and upgrades qualify for tax credit.

Important note: the 25C tax credits are not up-front savings on the purchase and/or installation of new appliances or equipment. Rather, they are factored into your tax credit amount when it’s time to file. Other qualifying costs for these items include equipment, installation, and labor costs. The professionals at Sherlock Air will provide the documentation you need to claim the tax credits when the time comes. Contact us at 760-935-6101.

NOTE: Sherlock Air cannot provide financial or tax advice. Please consult with a tax professional if you need help filing.

Before you make any decisions when making home improvements, you should keep in mind that certain Energy Star requirements have been set by in order to be eligible for the tax credit amount.

Who is eligible for the 25C tax credit?

The good news is that all North County, CA homeowners are eligible for the Energy Efficient Home Improvement Tax Credit. Any new qualifying equipment that is installed or any upgrades that are made after January 1, 2023 are eligible for the tax credit.

With the 25C tax credit, there is an annual cap of $1200 per household per year (not including heat pumps, which cap at $2000), and a total cap of $3200. This is the time to make those upgrades or improvements to boost your home’s energy efficiency and to save on your energy bills! Contact the professionals at Sherlock Air at 760-935-6101 for expert help and guidance on products and installation.

Use the 25C tax credit annually

The Energy Efficient Home Improvement 25C tax credit has resets each tax year through 2032. So if you have additional home improvement projects that qualify, you can claim the credit again year after year.

Claiming your tax credits

After you have completed your installation of your qualified energy property with Sherlock Air, we will provide you with documentation on your new qualified energy efficient upgrades to claim your tax credits. Give us a call at 760-935-6101.

As a reminder, Sherlock Air cannot advise you on taxes or other financial matters.

To find out just how much money you can save on your taxes through these credits, use this handy IRA savings estimation calculator.

Cleaner air, lower taxes

The Inflation Reduction Act was enacted to help Americans reduce the environmental impact of fossil fuels, lower their energy bills, and adopt cleaner and more efficient energy sources. By making the investment in energy efficient upgrades and improvements, North County, CA homeowners can take advantage of incentives in the form of tax credits and cash back rebates to save even more. If you want to save on energy bills while contributing to a cleaner and more sustainable future, consider investing in energy-efficient upgrades and appliances today. Don’t hesitate to reach out to us at Sherlock Air at 760-935-6101 and learn more about how we can help you take advantage of these money-saving opportunities.

Start saving energy and money today!

The trusted North County experts at Sherlock Air are here to help answer any questions you may have about the Inflation Reduction Act incentives, tax credits or rebates you qualify for. Whether you want to know more about the benefits of energy-efficient upgrades from heat pumps to electrical upgrades to energy efficient plumbing, or if you have questions about which options are best suited for your home, we are happy to assist. Contact us at 760-935-6101 today to make an appointment or ask any questions you may have about how you can take advantage of the Inflation Reduction Act.