The Inflation Reduction Act (IRA) has been making headlines lately, as it presents a massive effort to limit US carbon emissions amidst the climate crisis. Homeowners in North County, CA are eligible to receive incentives such as tax credits, rebates, and reduced electricity expenses through the IRA by modernizing their homes’ HVAC systems and making them more energy efficient.

How much can you save with IRA tax credits and rebates?

For North County homeowners, a smart investment in energy-efficient HVAC upgrades can result in substantial tax credits and rebates from the IRA up to $17,000. To figure out your savings potential, try using the calculator on Rewiring America’s website. If you’re thinking about making home improvements, the HVAC professionals at Sherlock Plumbing, Heating & Air are on hand to advise you on the options available to you.

Tax credits though the Inflation Reduction Act

We all like saving money on our taxes. Through the Inflation Reduction Act, North County homeowners who purchase and install energy-efficient home enhancements, such as doors and windows, air conditioners, furnaces, heat pumps, and more, can qualify for tax credits. Making the most of the IRA’s built-in tax credits is an excellent way to decrease the amount you owe in taxes.

The 25c tax credit for energy efficient home improvements

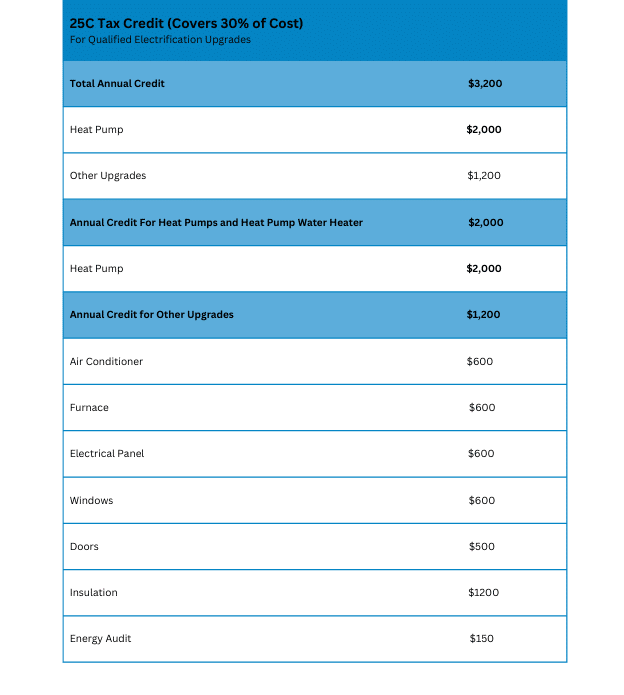

The Inflation Reduction Act’s Energy Efficient Home Improvement Tax Credit offers homeowners a 30% tax credit on select energy-efficient home upgrades, with a maximum benefit of $3,200 annually. A number of appliances and upgrades meet the requirements of this tax credit, including those listed below.

These savings are not immediately provided, but instead added to your tax credit amount at the time of filing. Sherlock Plumbing, Heating & Air can provide assistance with identifying the proper equipment to qualify for the tax credit—simply call 760-935-6282 for more information. To see how much you could save on utility bills each year, view the chart linked here.

You can find a full overview of the Energy Efficient Home Improvement Tax Credit and qualifying appliances here.

IRA 25c tax credit eligibility

If you are a homeowner in North County, CA, you can take advantage of the Energy Efficient Home Improvement Tax Credit. This credit is valid for any qualifying equipment that you install or upgrades you make after January 1, 2023. Each year, the tax credit has an annual cap: $1200 (without heat pumps) or $2000 (with heat pumps). There is also an overall cap of $3200. This is an ideal moment to carry out any planned home improvements and benefit from these tax savings! If you need help with the products or the installation process, please do not hesitate to call Sherlock Plumbing, Heating & Air at 760-935-6282.

How to claim your Inflation Reduction Act tax credits

At Sherlock Plumbing, Heating & Air, we are proud to provide you with the required paperwork to benefit from tax credits following the installation of qualified energy-efficient upgrades. Reach out to us at 760-935-6282 to discover more.

Utilize this IRA savings estimation calculator to determine how much you can save in taxes by taking advantage of these credits.

IRA home improvement rebates

Currently, residents of North County, CA are able to receive tax credits from HEEHRA and HOMES. However, the opportunity to receive rebates is slated for the end of 2023.

HEEHRA (High Efficiency Electric Home Rebate Act)

If you are part of a low- to moderate-income household wanting to buy energy-efficient electric appliances, the High Efficiency Electric Home Rebate Act can be of great assistance. With this program, rebates of up to $14,000 per year may be given to cover the electrification costs up to 100%. Nevertheless, it is necessary to meet the requirement of earning below the 150% area median income in order to qualify. You can acquire the rebates once the program starts this year. For more details, take a look at the chart below.

In most cases, you are able to acquire the rebate when you purchase the appliance through the HEEHRA. For more inquiries on the eligibility and if you meet the criteria for these rebates, you can call Sherlock Plumbing, Heating & Air at 760-935-6282 and they can give advice regarding purchasing and installation of these appliances.

Rebate Program for Home Owners Managing Energy Savings (HOMES)

The Homeowners Opportunities for More Energy Savings (HOMES) Program offers an incentive to reduce energy consumption by reimbursing homeowners for installing energy-efficient upgrades. These may include heat pumps, electrical improvements, and other home energy-saving systems. Homeowners who reduce their energy usage by 20%-35% could qualify for anywhere from $2000 to $8000 in rebates, with additional bonuses for low-income and moderate-income households. Moreover, the HOMES program will cover up to 80% of the project cost.

HOMES rebates are expected to be fully implemented by the end of 2023. When you’re ready to make any upgrades, give Sherlock Plumbing, Heating & Air a call at 760-935-6282 to see if rebates are available; the timing depends on Department of Energy and California regulations.

Creating a cleaner future with the Inflation Reduction Act

Sherlock Plumbing, Heating & Air is ready to answer any queries related to the Inflation Reduction Act and the potential of home improvement. This Act was created to reduce spending on fossil fuels, cut pollution and support the US’s clean energy solutions. It offers Americans lower taxes and even financial gains when purchasing energy-efficient devices. To discover more about the benefits available, give us a call any time at 760-935-6282.